RWA & Tokenization

In an increasingly digital world, even in investments and finance more broadly, tokenization is rapidly emerging as one of the key trends in the coming years. But what exactly is it? And how do Real World Assets (RWA) fit into this financial revolution?

What is Tokenization?

Tokenization is the process of converting real-world assets and services into digital tokens on a blockchain.

One of the most significant innovations brought about by tokenization is the creation of fractional ownership of assets. This concept allows individuals to purchase tiny fractions of high-value assets, such as famous works of art or unique items. For example, one person could own 1/100th of a painting or any other high-value asset. This unique situation is made possible solely by tokenization and blockchain technology, which offer an innovative solution compared to traditional investment methods.

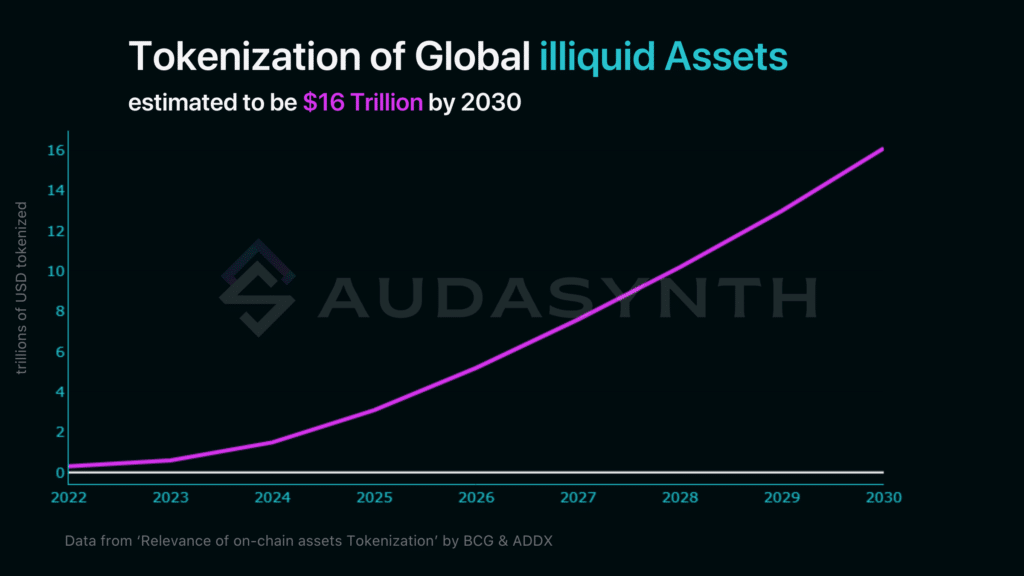

The total value of tokenized assets on the blockchain is growing exponentially. According to the Boston Consulting Group, the value of currently illiquid alternative assets (such as artwork, real estate, private equity) is estimated to reach $16 trillion by 2030.

Any asset can be tokenized and represented on a blockchain, with no inherent limitations. This prospect not only offers a clear investment opportunity, but also revolutionizes the very concept of investment. This new approach to fractional investments paves the way for greater democratization of investing, allowing a wider range of individuals to participate in opportunities from which they would traditionally be excluded. Additionally, the transformation of assets into digital tokens provides greater liquidity and market accessibility, further enhancing the appeal of this innovative investment model.

What are Real World Assets?

Real World Assets (RWAs) constitute a significant part of the global economy, encompassing both tangible assets (precious metals, gold, oil, art) and intangible ones (bonds, stocks, carbon credits). Despite their inherent solidity and value, RWAs have traditionally faced significant hurdles: their liquidity and accessibility in the financial market are limited. Retail investors, who have fewer investment opportunities compared to large entities like banks and funds, are often excluded from many types of investments (such as real estate and luxury goods). Additionally, the limited or non-existent liquidity poses another barrier to entering and exiting these investments.

With the advent of tokenization, a new chapter in the evolution of investments has opened. As previously mentioned, tokenization involves transforming assets and services into digital tokens that can be represented and traded on a blockchain or other decentralized networks.

Benefits of Tokenizing Real World Assets

Tokenizing Real World Assets offers numerous advantages. Firstly, it makes assets easily accessible and liquid, allowing investors to fractionalize assets like real estate and artwork, thus enabling investments with smaller amounts of money. It also greatly simplifies the transaction process itself, eliminating the need for financial intermediaries (thanks to Decentralized Finance) and reducing the costs and times associated with traditional operations. This opens new investment opportunities for a broader range of individuals and increases the possibility for portfolio diversification.

Tokenization also offers greater transparency and traceability, as all transactions are recorded on a public and immutable blockchain, ensuring the security and integrity of operations. This helps create a more trustworthy and efficient environment for investors, further increasing the attractiveness of Real World Assets as an investment class.

Use Cases of Tokenization

While still in its infancy, tokenization offers a range of benefits and opportunities across various sectors. Here are some notable examples:

- Commodities: Tokenizing commodities like gold or oil allows investors to access these markets more easily and transparently, without the need to physically manage the resources.

- Real Estate: Tokenizing properties enables investors to purchase shares of real estate, making property investment divisible and more accessible.

- Art and Collectibles: Tokenization can democratize investments in art and collectibles, allowing more investors to own a single valuable item.

- Financial Securities: Stocks, bonds, and other financial instruments can be tokenized, providing a more efficient and transparent way to trade these assets.

- Identity Verification: Tokenization can provide a secure and efficient tool for managing digital identities, with applications in online verification and access control.

- Supply Chain Management: Tokenizing products and components in supply chains can improve monitoring, authenticity verification, and transaction efficiency among parties.

Implementing Tokenization

Implementing tokenization requires a combination of blockchain technology, smart contracts, and appropriate regulations. One of the main challenges related to tokenization is the current regulatory complexity. There still is no clarity because the technology is new and not yet widely adopted. The second major challenge is the need for greater interoperability between different blockchain platforms. The final significant issue to address is having solid guarantees and robust security measures to protect tokenized assets.

By addressing these challenges, tokenization can truly revolutionize the way we invest, bringing about a more accessible, liquid, and democratic investment landscape.

Follow AudaSynth on Twitter and Telegram to stay updated!

Twitter/X: https://twitter.com/AudaSynth

Telegram Channel: https://t.me/audasynth_ann